File Form 2290 the way you like it

File on your own or get assistance from our customer service representatives. It's your choice.

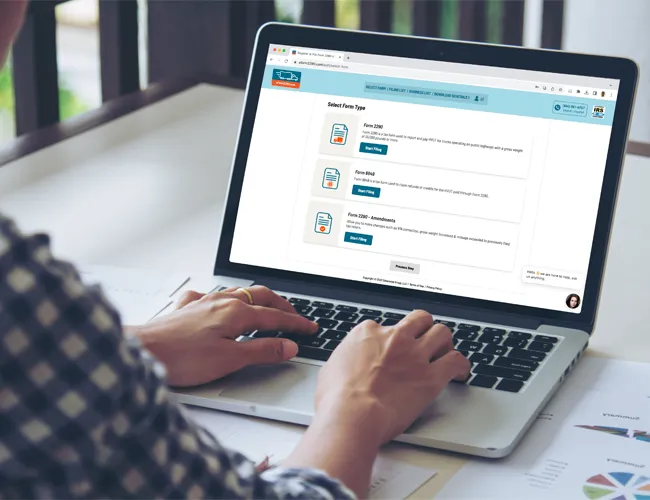

Self Service Filing Fast Lane Filing

- Register with eForm2290.com

- Fill in vehicle & company details

- Pay, submit & instantly get the stamped Schedule 1

Fully Assisted Filing Dial & File

- Give us a call on 866-881-6767

- Verify your contact details

- Share vehicle information

- Complete the payment and instantly receive the Schedule 1

Our ratings are a reflection of your trust

eForm2290 is trusted by trucking professionals like you and we take pride in keeping the trucking community ahead.

NaNNaNTax Refund Form 8849

Did not exceed your mileage use limit? Is your vehicle sold, stolen or destroyed? Claim for a refund with IRS using Form 8849.

Free VIN Corrections & Retransmission

Form 2290 got rejected? With our VIN corrections & Retransmissions, you can refile at a click of a button without any extra cost.

File Your Form 2290 with eForm2290

Click below to register and get started with your IRS Form 2290 filing!

Why choose eForm2290 to file HVUT online?

For detailed instructions on how to file Form 2290 with ease, please visit our instruction page.

Advantages of filing Form 2290 with eForm2290

Explore our blog section

Read our latest blogs to stay informed about everything related to IRS Form 2290.

Frequently asked questions about Form 2290

Yes you have to pay road tax for your new truck. You have to file 2290 heavy use tax whether you bought a brand new commercial motor vehicle or a used one. The HVUT 2290 tax was created to help fund road repairs caused by trucks and heavy transportation.

Therefore it is important to file your road tax 2290 and pay the HVUT tax for the new truck within the following month of purchase

For example, if you bought or used a truck for the first time in June 2023, you must file the road tax 2290 to the IRS by the end of July 2023. Failing to file 2290 on time may lead to penalties.

The federal tax form used to file HVUT ( Heavy Highway Vehicle Use Tax) is Form 2290. This 2290 tax form is often referred to as road tax or truck tax as well

IRS Form 2290 filing starts from July 1 to June 30. Make sure you submit your file to file Your IRS Form 2290 by August 31st to avoid late penalties.

If you are not running your truck, you still have to file your HVUT Form 2290. HVUT filing is simple on eform2290.com So whether the truck is running or not, one must file form 2290 to the IRS if it has a taxable gross weight of 55,000 pounds or more. However, if the truck has not crossed 5,000 miles (7,500 miles for agricultural vehicles) in a given tax period, it will be exempt from paying taxes. Make sure you file your heavy vehicle use tax before the season is over to avoid penalties.

The HVUT Form 2290 tax filing starts from July 2023

- You can file form 2290 by end of August 2023

- Post-August, the IRS charges late filing fees

- There is a 4.5% late charge on overall tax + 0.5% monthly interests

- E Filing services like ours make filing your 2290 truck tax quick and easy

If you forgot to make your HVUT payment before the deadline, there is a 4.5% late charge on overall tax + 0.5% monthly interests. You can avoid late payments for your 2290 heavy use tax by filing within the filing window.

Yes, you can claim a refund on your Heavy Vehicle Use Tax from the IRS.

- One, if you paid excess tax to the IRS on your Heavy Highway Vehicle

- When your truck has not crossed over 5000 miles in the previous tax period.

- When your truck is sold, stolen or destroyed in previous & current period

- You can use Form 2290 to claim your refund

Yes, eForm2290.com is an IRS-authorized IRS Form 2290 e-file service provider

- eForm2290.com has been helping truckers and tax professionals to file 2290 safely online for over 10 years

- 200k+ safe 2290 e-filing and still counting. File your 2290 highway tax with us for quick and easy tax filing.

eForm2290.com is an IRS-authorized e-file provider which ensures safe 2290 filing

- CCPA compliant which reflects data security

- Easy 3-step 2290 filing. Register, enter truck details, and submit heavy vehicle use tax (HVUT)

- 1-step quick re-filing for existing VINs

- Free VIN correction

- Free Form 2290 correction in case of rejection in the submitted return

The e-filing 2290 charges depend how many 2290 forms you file. In order to reduce the charges, you can subscribe to our emails. We often give exciting discounts on 2290 filing charges.

The following information is required for 2290 online filing. It is easy to follow the form 2290 instructions with e file form 2290 filing.

You must keep the below 4 key details with you during form to 2290 e-file

- EIN 1: This is a 9-digit Employee Identification Number

- Business Name 2: You can find both Business Name and EIN on the SS-4 assigned to you by the IRS

- VIN 3: Vehicle Identification Number could be found on the vehicle registration document or on the truck near the engine or driver's seat.

- Banking Information 4: Keep your account number, routing number, etc handy to ensure smooth and accurate filing.

No, you should not use your social security number to file IRS 2290 form. The IRS requires an Employer Identification Number (EIN) to complete your Form 2290 filing.

Yes, you can add multiple businesses to your eForm2290.com account and file your form 2290 truck tax in a matter of minutes!

Is electronic Form 2290 filing difficult?

- If you are filing form 2290 online for the first time, this video might help

- If you are filing 2290 highway tax for multiple vehicles, check out this video

- You can also use the " File 2290 by Phone" option to file your HVUT return

- Also, our customer service representatives are available 24*7 to assist you. Call us at 866-881-6767or email us at support@eform2290.com

You can also find a printable 2290 form and download to print within your account or via email.

You have 4 options to pay your 2290 tax

- Electronic Funds Withdrawal (EFW) 1: If you are selecting EFW, please ensure you have a sufficient balance in your account to avoid fines from the IRS.

- Electronic Federal Tax Payment System (EFTPS) 2: The payment link will be sent to your email address. This link will redirect you to the IRS page for 2290 heavy use tax payment. Be sure to make the hvut payment within 10 business days in order to avoid the late payment charges. Learn more about EFTPS Payment

- Debit or Credit 3: This is the fastest and easiest way to submit the taxes. You can either use a debit card or credit card. Make sure to enter the card details right.

- Money Order / Check Payment 4

This is the best way for 2290 road tax pay online.

You must keep 2 things in mind while filing form 2290 online, in order to ensure safe and secure filing.

- Go for an IRS-authorized e-service provider

- Look for a service that has good customer service. It will be a lot easier for you to file 2290 irs form online

Yes, you can save your 2290 heavy use tax form and submit it later.You can enter all the necessary information about your 2290 tax form and have the details saved on our platform. We will email you your 2290 tax form in progress so you can pick up where you left off.

There are multiple ways to file form 2290 online. You can register with an IRS-authorized e-file provider. For instance, eForm2290.com is an IRS-authorized website With eForm2290.com you can e-file 2290 in 2 ways:

- Either you can log in to your account and submit the 2290 tax form

- Or, you can use the "File by Phone" option

You can just give us a call at (866) 881-6767

Yes, you must pay the service charge upfront to e-file form 2290 on eForm2290.com.

To file multiple IRS 2290 forms, follow the steps given below:

- Login to your registered eform2290.com account

- Under form 2290 filing*, you will have 2 options

- Single Vehicle Filing and "Multiple Vehicle Filing"

- Select "Multiple Vehicle Filing" and proceed to file

- Use the "Bulk Data Upload" option for easy and fast filling

- You can simply download the "Template", enter the vehicle information in the given format and upload it back.

*Tip - For existing users, you can also file using our view copy feature on the dashboard

You will know the IRS received your 2290 tax form once you submit your 2290 form using eForm2290.com, you will receive a submission confirmation email notification. You will also receive free updates regarding your filing status via SMS and emails.

You can always reach our support @ (866)-881-6767 to correct your rejected form. Our support representative will correct your form with no additional service fee.

Yes, you will receive proof of payment, it is known as Form 2290 Schedule-1, which will have a watermark on it. If you file with eForm2290.com, you will receive your 2290 Form Schedule-1 within a few minutes of filing; here you will get 2290 online payment confirmation.

You will receive your form 2290 Schedule-1 via your registered email address on the same day of filing except for weekends and holidays.

If you have filed form 2290 heavy vehicle use tax return with eForm2290.com, you will receive your 2290 Schedule-1. Your Schedule 1 will be sent to your registered email address.

- Generally, you should receive it on the same day of hvut filing

- If you e-filed 2290 on a holiday or weekend, you will receive it on the following working day.

- Check your spam for your 2290 tax form Schedule 1 if you cannot find it in your inbox.

You can file separate 2290 forms for the vehicles that you've missed out on previously.

If the weight of your vehicle increases after filing a 2290 return, you can file an amended 2290 return to report the gross weight increase.

If the mileage of your vehicle exceeds, Yes, you need to e-file Form 2290 by making an amendment

- You can simply use the IRS 2290 Amendments to make the correction to your irs form 2290

- If you have filed with eForm2290.com, We can help to make an amendment even if the actual form was not submitted with us. (Excluding VIN Correction)

- Login to your account and click on "Amendments" to proceed

Transferring your form 2290 to a new vehicle is not possible. However, you can apply for a refund on the tax paid on the old vehicle and get your money back if it has not crossed 5,000 miles. You must file a separate form 2290 for the new vehicle and request for a tax refund for the old vehicle by filing a form 8849..

Your 2290 tax return details will be stored on our database till you opt to delete your eForm2290.com account.