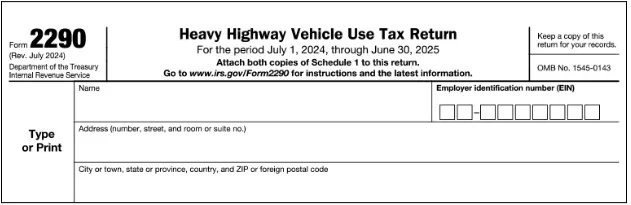

Form 2290 is an IRS tax return used to report and pay the Heavy Vehicle Use Tax (HVUT) for trucks and other heavy vehicles with a taxable gross weight of 55,000 pounds or more that operate on public highways. It applies to owner-operators, fleet managers, and trucking companies that register qualifying vehicles in their name.

The HVUT is an annual federal tax and the collected revenue funds highway construction, repair, and maintenance projects across the United States. Filing Form 2290 is a mandate for IRS compliance and a non-negotiable.

If you're filing Form 2290 for the first time or even looking for a refresher—we’ve created this easy-to-follow guide to help you navigate each section of the form step by step.

When is Form 2290 due?

Form 2290 is due by the last day of the month following the vehicle’s First Used Month (FUM). For instance, if your vehicle was first used on a public highway in July, your Form 2290 must be filed by August 31.

The upcoming HVUT tax period runs from July 1, 2025, to June 30, 2026. To avoid penalties and interest, ensure you file and pay your HVUT by the deadline based on your vehicle’s first month of use.

What do you need to file Form 2290?

Before you start filling out Form 2290, make sure you have the following details handy:

1. Employer Identification Number (EIN)

You must have an Employer Identification Number (EIN) to file—Social Security Numbers (SSNs) are not accepted. If you don’t already have an EIN, you can apply for one online at IRS.gov. If you’re outside the U.S., such as in Canada, you can call 267-941-1099 (note: this is not a toll-free number). Alternatively, submit Form SS-4 by fax or mail to request your EIN.

2. Vehicle Identification Number (VIN)

You’ll need the VIN for each vehicle you’re reporting. This 17-character number is usually found on your vehicle title, registration, or stamped on the vehicle itself. Double-check that you’re using the VIN of the truck, not the trailer.

3. Taxable gross weight of the vehicle

This determines how much tax you owe. For each vehicle, calculate the taxable gross weight by adding:

- The empty weight of the truck when it’s fully equipped for service,

- The empty weight of any trailer or semitrailer it typically pulls (also fully equipped), and

- The maximum load weight that’s usually carried by the truck and its trailers.

IRS Form 2290 for 2025-2026 - Line by line instructions

Filing IRS Form 2290 can feel overwhelming at first, but a step-by-step breakdown makes the process much easier. This form is divided into two main parts, along with some basic information.

Here’s a breakdown of each field on Form 2290 and what you need to enter.

Basic business information

This section of Form 2290 requires you to provide essential business information.

- Name & address:

Make sure the name and address you provide match your official tax records to avoid delays in processing or possible penalties. Be sure to list the name and address of the individual or business that owns the vehicle(s) you’re reporting. Your address should be complete, including the street name, city, state, and ZIP code, so that the IRS can process your return without any delays. - EIN (Employer Identification Number):

Enter the valid Employer Identification Number (EIN) — this is required for processing. Remember SSNs (Social Security Numbers) aren’t accepted.

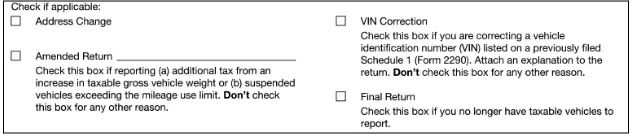

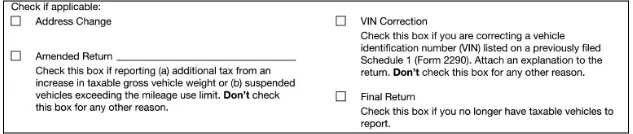

Changes to business information

This section is designed for making changes to a previously filed Form 2290 or for submitting a final return, such as when you’re exiting the business or replacing a vehicle. This part includes four specific checkboxes to indicate the reason for the amendment or final filing.

- Address change:

If you’ve recently moved or updated your business address, be sure to check the “Address Change” box. This allows the IRS to update your records with your new mailing address. - VIN correction:

Made a mistake on a Vehicle Identification Number (VIN) in a previously filed Schedule 1? Select the “VIN Correction” box. Be sure to list the corrected VIN(s) on the new Schedule 1 and attach a brief statement explaining the correction. Also, make sure you’re using Form 2290 for the same tax year you’re correcting. - Amended return:

Use this box if you’re reporting a change, such as an increase in the vehicle’s taxable weight or a suspended vehicle that exceeded mileage limits. - Final Return:

If you’re closing your business or no longer have vehicles to report, check this box. Sign and submit it to inform the IRS that this is your final 2290 return.

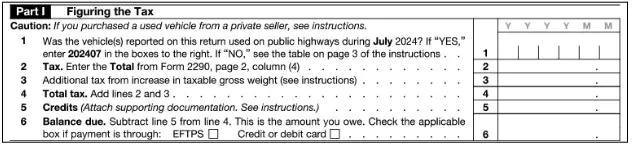

Form 2290 Part I – Figuring the Tax

Form 2290 Part I – Figuring the Tax

In Part I of Form 2290, you’ll need to report the Vehicle Identification Number (VIN) and the taxable weight category for each heavy vehicle you're filing for.

This section plays a key role in calculating how much Heavy Vehicle Use Tax (HVUT) you owe. The amount is based on different factors like your vehicle’s first use month, taxable gross weight, and vehicle type. Getting this part right is critical as it helps ensure accurate tax reporting, prevents miscalculations, and protects you from potential IRS penalties arising therefrom. ere’s a guide to help you through each line in Part I of the form.

Line 1:

Enter the month the vehicle was first used on public highways during the tax period.

See When To File for the corresponding date and format.

Line 2:

This section is designed for making changes to a previously filed Form 2290 or for submitting a final return, such as when you’re exiting the business or replacing a vehicle. This part includes four specific checkboxes to indicate the reason for the amendment or final filing.

Line 3: Additional tax for weight increase

Complete Line 3 of Form 2290 only if a vehicle's taxable gross weight increases during the tax period, causing it to fall into a higher tax category. For example, if the maximum load the vehicle carries increases, it may move into a new tax bracket.

Use this line to report the additional tax owed for the remaining tax year due to the weight increase. Do not include this amount on Line 2 unless you're also reporting other taxable vehicles on the same return.

Make sure to check the “Amended Return” box at the top of Form 2290, and indicate the month the weight increased next to it. File the amended Form 2290 and the updated Schedule 1 by the last day of the month following the month in which the weight change occurred.

Line 4: Total tax

Add Lines 2 and 3. This is your total tax before any credits.

Line 5: Credits

Complete Line 5 only if you’re requesting a tax credit already paid on a vehicle that meets one of the following conditions:

- The vehicle was sold before June 1 and was not used for the rest of the tax period.

- The vehicle was destroyed (damaged beyond reasonable repair) or stolen before June 1 and was not used afterward.

- The vehicle was used in the previous tax period for 5,000 miles or less, or 7,500 miles or less if it’s an agricultural vehicle.

Credits cannot be claimed for temporary changes in usage, occasional light loads, or minor reductions in mileage and only significant qualifying events are eligible.

The amount you claim on Line 5 cannot exceed the tax reported on Line 4. If the credit amount is greater, you must file Form 8849 along with Schedule 6 (Form 8849) to request a refund. Schedule 6 should also be used to claim refunds due to overpayments or errors in previously filed Form 2290 returns.

The amount you claim on Line 5 cannot exceed the tax reported on Line 4. If the credit amount is greater, you must file Form 8849 along with Schedule 6 (Form 8849) to request a refund. Schedule 6 should also be used to claim refunds due to overpayments or errors in previously filed Form 2290 returns.

Supporting documentation for credit claims

When claiming a credit on Form 2290 for a vehicle that was sold, stolen, or destroyed, you must attach a separate sheet providing a detailed explanation for each vehicle. Be sure to include the following information:

- The Vehicle Identification Number (VIN)

- The vehicle’s taxable gross weight category

- The exact date the vehicle was sold, stolen, or destroyed

- A completed worksheet showing how the credit was calculated (see “Figuring the Credit” section in the instructions)

- For vehicles sold on or after July 1, 2015, include the name and address of the purchaser

Failure to submit all required details may result in your credit claim being denied by the IRS.

Line 6 – Balance Due

To calculate the amount you owe, subtract the credit amount on Line 5 from the total tax on Line 4. Enter the result on Line 6—this is your balance due to the IRS.

If you're making a payment, choose your preferred payment method by selecting the appropriate box. You can pay using: EFTPS (Electronic Federal Tax Payment System), credit, or debit card via IRS payment processors.

Part II – Statement in Support of Suspension

If you have vehicles that are used strictly for agricultural work or logging, you might not have to pay the HVUT on them, at least not right away. Part II of Form 2290 allows you to provide a formal statement requesting suspension of the tax payment for such qualifying vehicles.

This part covers Lines 7 through 9 and requires details like the total number of vehicles you're reporting, including any that qualify for suspension.

Line 7:

If you have a vehicle that you don’t expect to drive more than 5,000 miles during the tax period (or 7,500 miles for agricultural vehicles), you may be eligible to suspend the HVUT for that vehicle.

To request this suspension, you’ll need to fill out Line 7 of Form 2290, providing key details such as:

- The Vehicle Identification Number (VIN)

- The purchase date

- The estimated mileage for the upcoming tax year

The IRS reviews this information to determine if your vehicle qualifies for a tax suspension. But you’re not done just yet as there are a couple of important steps to follow:

- List all suspended vehicles on Schedule 1, making sure they are marked under Category W

- Then, count the number of vehicles for which you’re claiming suspension and enter that number in Schedule 1, Part II, line b

If you’re reporting vehicles that will travel less than 5,000 miles (or 7,500 for farm vehicles) during the tax year, list them here to suspend the tax. You’ll also need to:

- List these vehicles on Schedule 1, and

- Enter the total number of suspended vehicles in Schedule 1, Part II, Line B.

Line 8a:

You are required to verify the mileage use of vehicles reported as suspended on your previous year’s Form 2290. If those vehicles were operated 5,000 miles or less (or 7,500 miles or less for agricultural vehicles), they remain tax-exempt for that period.

To confirm this, check box 8a—this certifies that all suspended vehicles from the prior period stayed within the allowable mileage limit, except any listed in 8b.

Line 8b

If any of those vehicles exceeded the mileage limit during the tax year, you must report them by entering their Vehicle Identification Numbers (VINs) on Line 8b. These vehicles are no longer considered suspended and are subject to tax for the prior period. You must file a separate Form 2290 for that prior period and pay the appropriate tax.

Refer to the IRS guidelines on suspended vehicles.

Line 9:

If you sold, transferred, or otherwise disposed of any vehicles that were reported as suspended on your Form 2290 for the previous tax year (July 1, 2024 – June 30, 2025), you must report those changes here.

Provide the Vehicle Identification Numbers (VINs) along with the name of the new owner and the date of transfer or sale. This confirms that the vehicles were still eligible for tax suspension at the time they changed ownership. If you need more space, attach a separate sheet with the full list of affected vehicles and details

Other sections

Third Party Designee:

If you’d like to authorize someone (like an employee or tax preparer) to speak with the IRS on your behalf, check “Yes” and enter their name, phone number, and a 5-digit PIN they choose.

Form 2290 includes a Third Party Designee section that allows you to authorize another person—such as an employee, tax preparer, or other trusted third party—to communicate with the IRS on your behalf regarding your return. To grant permission, check the “Yes” box and provide the designee’s name, phone number, and a five-digit personal identification number (PIN).

By doing so, you authorize the IRS to speak with the designated person about the specific Form 2290 filing. This includes answering questions, exchanging information, and receiving written details related to the return, such as notices or copies of the tax filing. Keep in mind, that this authorization applies only to the tax period and form listed, and you must also sign and date the section to make it valid.

Signature:

Signing Form 2290 is a mandatory final step in the filing process. The IRS will not consider an unsigned return as filed, and it will be returned to you for proper completion.

After reviewing the information for accuracy, please sign and date the form, and include a contact telephone number. If you’re filing electronically, you may use a digital signature or an IRS-issued PIN. For paper filings, a handwritten signature in ink is required. By signing, you are declaring—under penalties of perjury—that all information provided is true, accurate, and complete to the best of your knowledge.

Paid Preparer Use Only:

The “Paid Preparer Use Only” section on Form 2290 must be completed by a tax professional who was paid to prepare the return and is not an employee of the business filing the form.

In this section, the preparer must provide their full name, address, Preparer Tax Identification Number (PTIN), and—if applicable—the name and Employer Identification Number (EIN) of the tax preparation firm. It’s important to note that a firm’s PTIN cannot be used in place of the individual preparer’s PTIN.

The preparer must also sign the return to certify that it was completed accurately and provide a copy of the filed return to the taxpayer in addition to the version submitted to the IRS. While a paid preparer may assist with completing the form, the responsibility for the accuracy of all information and the payment of any taxes ultimately rests with the taxpayer.

Tax Computation for HVUT (Heavy Vehicle Use Tax) - Instructions

The Heavy Vehicle Use Tax (HVUT) is calculated based on a vehicle’s taxable gross weight and the number of taxable vehicles you operate. Gross weight categories start at 55,000 pounds (Category A) and go up to 75,000 pounds or more (Category V).

Tax Amount = (Annual Tax or Partial-Period Tax) × Number of Vehicles

To calculate your total HVUT:

- Identify the taxable gross weight of each vehicle.

- Group vehicles by weight category and enter them on the appropriate row in the Tax Computation Table.

- For each category, multiply the applicable tax rate by the number of vehicles in that category.

- Add the totals to determine your overall HVUT liability.

Once you’ve completed your tax calculation, the next step is to submit payment to the IRS.

Tax Computation for HVUT (Heavy Vehicle Use Tax) - Instructions

Here’s how to use each column of the Tax Computation Table:

Column (1) – Annual Tax:

Use column (1)(a) to find the tax amount for vehicles first used in July. If the vehicle is a logging vehicle, refer to column (1)(b) for the reduced tax rates. For more details, see the section titled Logging Vehicles.

Column (2) – Partial-Period Tax:

If the vehicle was placed in service after July, calculate the tax based on the remaining months in the tax year. Use Table I for regular vehicles and Table II for logging vehicles to find the correct amount. Report this in column (2)(a) for regular vehicles and (2)(b) for logging vehicles. If the vehicle was purchased from a private party, see the instructions under Used Vehicles.

Column (3) – Number of Vehicles:

Enter the number of vehicles by weight category (A–V) in the appropriate columns. Add the figures from columns (3)(a) and (3)(b) and enter the combined total. For Category W (suspended vehicles), report the number separately in the appropriate column.

Column (4) – Total Tax Amount:

Multiply the tax amount from Column (1) or (2) by the number of vehicles in Column (3) for each category. Add up the results for all categories (A–V) and enter the final total in Column (4).

Once you’ve completed the table, transfer the total tax amount to Line 2 of Form 2290.

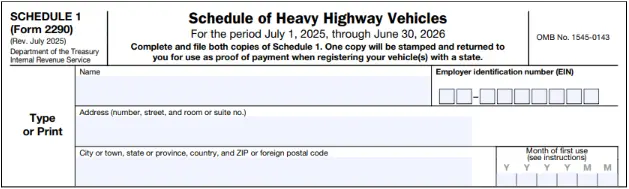

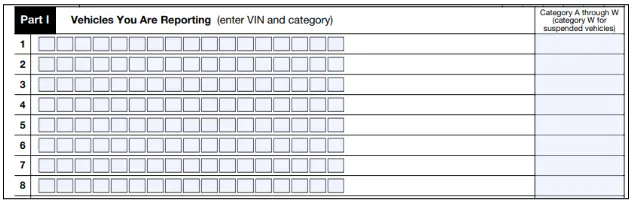

Schedule 1 (Form 2290) instructions

You must complete and submit both copies of Schedule 1 when filing Form 2290. The IRS will stamp the second copy and return it to you as proof of payment. Failure to attach Schedule 1 to your Form 2290 may result in your return being rejected.

E-Filing: If you file Form 2290 electronically, a copy of Schedule 1 with an IRS watermark will be sent electronically to the Electronic Return Originator (ERO), transmitter, and/or Internet Service Provider (ISP). You should request the original electronic Schedule 1 from your ERO, transmitter, or ISP for your records.

Requesting Prior-Period Copies: To obtain a copy of Schedule 1 from a previous tax period, send a written request to:

Internal Revenue Service

7940 Kentucky Drive

Florence, KY 41042-2915

How to complete Schedule 1

Name and Address:

Enter your name and address exactly as they appear on Form 2290. Ensure the Employer Identification Number (EIN) matches what is shown on page 1 of Form 2290.

Month of First Use:

Enter the same date as listed in Part I, Line 1 of Form 2290.

Part I – Vehicle Information:

List the Vehicle Identification Number (VIN) for each vehicle being reported. Omitting the full VIN could delay or prevent your vehicle’s state registration.

Part II – Vehicle Counts:

Line a: Enter the total number of vehicles reported on page 2 of Form 2290.

Line b: Enter the total number of taxable vehicles listed as suspended (Category W) on Form 2290, page 2, column (3).

Line c: Calculate the number of taxable vehicles by subtracting line b from line a.

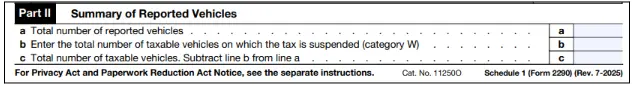

Schedule 1 (Form 2290), Consent to disclosure of tax information

When you file Form 2290, the IRS may share specific information from Schedule 1, including the Vehicle Identification Numbers (VINs) and confirmation that the Heavy Vehicle Use Tax (HVUT) has been paid (as reported on Line 6).

This information is shared with government agencies such as the Department of Transportation (DOT), U.S. Customs and Border Protection, and state Departments of Motor Vehicles (DMVs) to verify compliance.

To authorize the IRS to release this information, you must sign and date the consent section on Schedule 1. Without your consent, the IRS cannot share your tax information with these agencies, which could delay vehicle registration or cross-border operations.

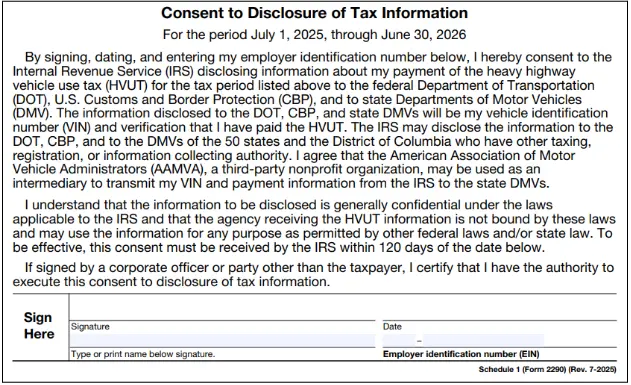

Form 2290-V – Payment Voucher Instructions

Use Form 2290-V when you are submitting a check or money order as payment along with your Form 2290 (Heavy Highway Vehicle Use Tax Return). This voucher helps the IRS process your payment more efficiently and ensures it is properly credited to your account.

If a third party (like a tax preparer) is filing your return and a payment is required, be sure to provide them with a completed Form 2290-V.

Note: You do not need to submit Form 2290-V if you're paying your tax due (from Line 6 of Form 2290) electronically through EFTPS, credit/debit card, or direct debit.

Refer to the “How to Pay the Tax” for more information.

How to complete Form 2290-V

Box 1: Enter your Employer Identification Number (EIN). If you don’t have one, you can apply online at www.irs.gov/EIN. International applicants (for example, from Canada) must call +1-267-941-1099 (not toll-free) or submit Form SS-4 by fax or mail.

Box 2: Fill in the payment amount from Line 6 of Form 2290.

Box 3: Enter the tax period beginning date as shown on Line 1 of Form 2290.

Box 4: Write your name and address exactly as they appear on Form 2290.

How to complete Form 2290-V

- Make your check or money order payable to “United States Treasury.”

- On the check/money order, include: Your EIN, the phrase “Form 2290,” and the tax period (same as Line 1 on Form 2290)

- Do not send cash, and do not staple the voucher or payment to your return or each other.

- Detach Form 2290-V and mail it along with your payment and completed Form 2290 to the address listed on the bottom left of the Form 2290-V.

If you’re using a private delivery service (PDS), keep in mind that they cannot deliver to IRS P.O. box addresses. In such cases, you must use the U.S. Postal Service.

How to file IRS Form 2290 (HVUT)?

You can file IRS Form 2290, the Heavy Vehicle Use Tax (HVUT) return, either electronically (e-file) or through paper filing. While both methods are accepted by the IRS, e-filing is strongly recommended for its speed, accuracy, and convenience

1. Electronic filing (E-filing)

E-filing is the fastest and most efficient way to submit Form 2290. The IRS encourages taxpayers to file electronically, especially for fleets with 25 or more vehicles, because e-filed returns are processed more quickly, and the IRS-stamped Schedule 1 is typically delivered within minutes. You can e-file Form 2290 directly through the IRS or by using an IRS-authorized e-file provider such as eForm2290.

How to E-File IRS Form 2290 in 3 Easy Steps

E-filing your HVUT Form 2290 is quick, efficient, and can be completed in just three simple steps. Before you begin, make sure you have your business details, Employer Identification Number (EIN), Vehicle Identification Number (VIN), taxable gross weight, and the first used month (FUM) ready.

Step 1: Start by entering all the required information, including your business name, EIN, VIN, the taxable gross weight of your vehicle, and the first month the vehicle was used on public highways.

Step 2: Once all the details are filled in, carefully review the information for accuracy. Then, pay the tax due using one of the IRS-approved payment options—Electronic Funds Withdrawal (EFW), the Electronic Federal Tax Payment System (EFTPS), or a credit/debit card.

Step 3: After reviewing and paying, submit your return to the IRS. Upon successful filing, you will receive your IRS-stamped Schedule 1—delivered directly to your registered email, often within minutes. This document serves as official proof of HVUT payment and is required for truck registration and renewal.

2. Paper Filing

Paper filing involves manually completing Form 2290 and mailing it to the IRS. This method takes longer to process, and you’ll need to plan to meet the deadline. Schedule 1 will be returned by mail after your form is processed.

If you choose to file by mail, ensure your return is submitted well in advance to account for mailing and processing time.

How to pay the balance tax due when e-filing Form 2290?

While completing Step 2 of the Form 2290 e-filing process, if you owe any tax, you can conveniently pay the balance using one of the IRS-approved payment methods. The IRS requires that the full tax amount be paid when filing Form 2290.

Here are the available payment options:

Electronic Funds Withdrawal (EFW):

This direct debit option allows you to authorize a one-time withdrawal from your bank account at the time of e-filing. It’s simple, secure, and processed automatically with your return submission.

Electronic Federal Tax Payment System (EFTPS):

If you're already enrolled in EFTPS, you can schedule a payment through the system before or after you file your return. It offers flexibility and control over your payment timing.

Credit or Debit Card:

You can make a secure payment using your credit or debit card through authorized IRS payment processors. Service fees may apply based on the payment provider.

Check or Money Order:

Though not an online option, you can still choose to mail a check or money order along with Form 2290-V (Payment Voucher) if you're filing by paper. This option is not available for electronic filing.

File IRS Form 2290 with eForm2290

Get started today with eForm2290 and e-file your Form 2290 quickly and securely in just a few minutes. Once filed, your IRS-stamped Schedule 1 is delivered straight to your registered email—usually within minutes. You also have the option to receive your Schedule 1 via fax or postal mail, based on your preference.

With 24/7 filing access, instant error checks, free VIN corrections, and dedicated U.S.-based support, eForm2290 simplifies the entire HVUT filing process. Whether you're an owner-operator or managing a fleet, eForm2290 ensures fast, accurate, and IRS-compliant submissions; so you can stay on the road without delays.