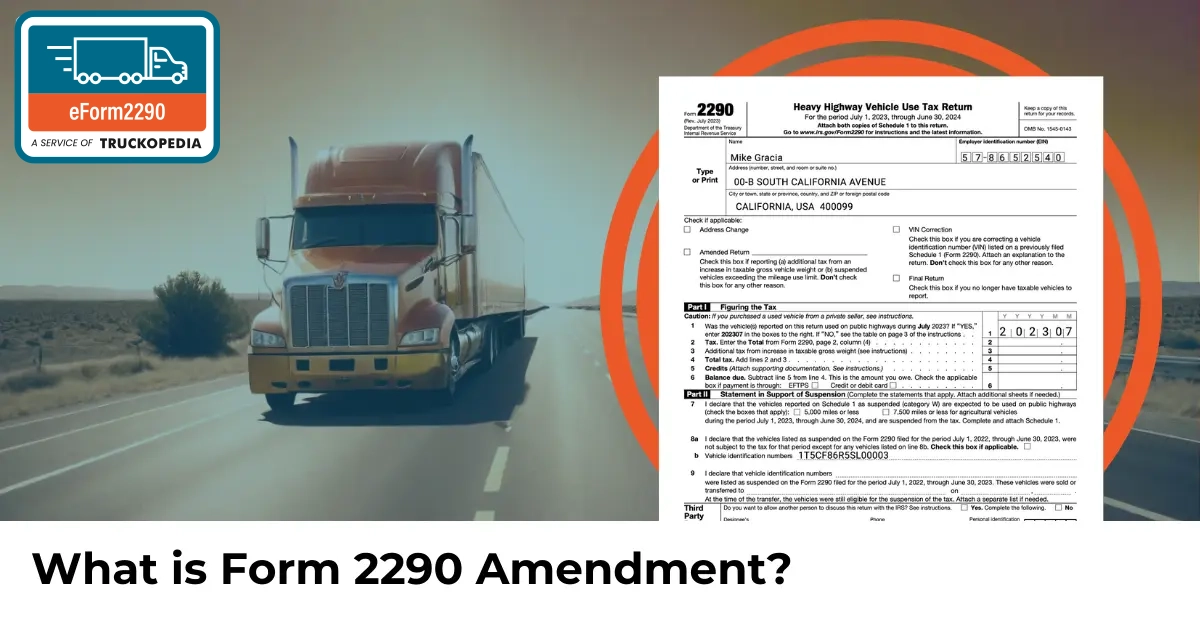

Form 2290 Amendments lets you correct your filing mistakes, update vehicle details, or revise business information on your original filing. Filing an Amendment online is easy, quick and helps you stay IRS compliant. Your 2290 filing requires an update? E-File your 2290 Amendment today!

Form 2290 is a federal tax form that businesses use to report and pay the Heavy Highway Vehicle Use Tax (HVUT). This tax applies to vehicles with a taxable gross weight of 55,000 pounds or more. Businesses, owner-operators, truckers, and other entities must file Form 2290 and pay the applicable tax by the last day of the month following the month the vehicle was first used on public highways.

But what if something changes during the tax year—like your vehicle details or business information? Or what if your original Form 2290 filing has an error? That’s where Form 2290 amendments come in. Amendments let you correct mistakes, update vehicle information, or revise business details from your original filing. Whenever changes occur, it’s important (and required) to submit an amended Form 2290 to keep your IRS records accurate and stay compliant.

What is the 2290 Amendment Form?

The Form 2290 Amendment is used to update certain details on your originally filed Form 2290, which is required for reporting and paying the HVUT.

If you've already filed your Form 2290 and something changes—like the taxable gross weight of your vehicle, or if a vehicle becomes suspended or goes over the mileage limit—you’ll need to file a 2290 Amendment. This ensures your HVUT records stay accurate and compliant with IRS requirements.

When to file the 2290 amendment?

You must file a Form 2290 amendment when there are significant changes to the information originally reported on your Form 2290. The IRS requires businesses to submit an amendment to ensure that tax records accurately reflect the status of a vehicle.

There are three common situations were filing a form 2290 amendment is necessary:

- Increase in Taxable Gross Weight

If the gross weight of your vehicle increases and places it in a higher weight category, additional tax will be due. In such cases, an amendment must be filed to report the increased weight and pay the difference in tax. - Exceeding the Mileage Use Limit

Vehicles that were initially reported as suspended (under the 5,000-mile annual limit or 7,500 miles for agricultural vehicles) must be amended if they exceed this mileage threshold. This changes the vehicle’s taxable status and requires payment of HVUT.

Correction of a Vehicle Identification Number (VIN)

If you made an error in the VIN on your original form 2290, a VIN correction amendment must be filed to fix the mistake. This ensures your tax records match your vehicle registration details.

Form 2290 amendment for increase in Taxable Gross Weight

An amended form 2290 must be filed if the taxable gross weight of a vehicle increases during the period. When this happens, your vehicle moves into a new weight category, leading to an increase in the HVUT. To comply with IRS regulations, you must report this change and pay the additional tax on form 2290.

When is the form 2290 amendment due?

The deadline to file the amended return for increase in taxable gross weight is the last day of the month following the month in which the weight increase occurred.

For example, if your vehicle’s taxable gross weight increases in July, you must submit a 2290 amendment to report the new taxable weight and pay the additional tax by August 31.

Not sure how much extra tax you owe? Use the 2290 tax calculator—simply enter your vehicle’s first-used month and new gross weight, and it will calculate the additional tax amount for you.

Form 2290 amendment for exceeding Mileage Use Limit for suspended vehicles

An amended form 2290 must be filed and pay the HVUT tax if your vehicle was

originally reported as a suspended vehicle exceeding the mileage use limit.

A vehicle is considered as a

suspended vehicle if the mileage limit for heavy vehicles on public highways

is 5,000 miles or less (7,500 miles or less for agricultural vehicles). This

limit applies to the total miles driven on public highways during the tax

period, regardless of the number of owners.

You must report the month

in which the vehicle exceeded the mileage limit and pay the additional tax

on form 2290.

Form 2290 amendment for VIN correction

If you made a mistake with the Vehicle Identification Number (VIN) on your original filed form 2290, you’ll need to file a VIN

correction amendment to update the IRS records. Entering an incorrect VIN

can lead to filing rejections, IRS notices, or even penalties for inaccurate

reporting.

The original tax must have been paid on the initial form

2290 filing. If not, you may face IRS penalties.

VIN corrections can only be made for taxable or suspended vehicles. You cannot correct

VINs for credit vehicles or those suspended in the prior tax year. You

cannot claim a tax credit on the same form where you're filing a VIN

correction.

When is the 2290 amendment for VIN correction due?

There is no specific deadline for filing a VIN correction—you can submit it

any time after identifying the mistake. However, correcting it as soon as

possible ensures accurate tax records and helps avoid potential delays.

Leaving

the mistake uncorrected may result in penalties or fines for inaccurate tax reporting.

How to file a form 2290 amendment?

You can file the amendment electronically through an authorized e-file provider such as eform2290 or mail a paper form 2290 with the necessary corrections to the IRS.

If

the amendment involves a weight increase, be sure to calculate and pay any

additional tax due. Always keep a copy of the amended return for your

records.

How to e-file form 2290 amendment?

Need help filing your 2290 Amendment? Our team at eForm2290 is always here to guide you through the process!

Log in using your registered email address and password.

From your dashboard, click on “Make an amendment”

Select the business you want to update from the dropdown menu. If your business isn’t listed, you can add a new one. Then, click “Start e-filing.”

Choose the first-used month and year of your vehicle and indicate if you're filing a final return.

Select the type of amendment you need to file:

- VIN Correction

- Taxable Gross Weight Increase

- Mileage Use Limit Exceeded

Enter the updated information and any other required details as requested.

Carefully review all the information to ensure accuracy.

Click on ‘IRS Payment’ to proceed.

Select your preferred payment method — Electronic Funds Withdrawal (EFW), Electronic Federal Tax Payment System (EFTPS), or check/money order — and complete the process.

Following these steps will help you successfully submit your form 2290 amendment without hassle.

How to paper file form 2290 amendment?

If you’ve already filed form 2290 and need to make changes, the process for filing an amendment remains the same, with one additional step—checking the ‘Amended Return’ box.

You should select this box if:

- You are reporting additional tax due to an increase in taxable gross weight.

- You are reporting on a suspended vehicle that has exceeded the mileage use limit.

For VIN corrections, instead of the ‘Amended Return’ box, check the ‘VIN Correction’ box.

After completing the form, carefully review all the information before mailing it to the IRS.

How to paper file form 2290 amendment?

If including a payment (check or money order):

Internal

Revenue Service

P.O. Box 932500

Louisville, KY 40293-2500

If no payment is included:

Department of the Treasury

Internal

Revenue Service

Ogden, UT 84201-0031

File a 2290 amendment

Amending Form 2290 is an important step to ensure that all information

reported to the IRS is accurate and up to date. However, it's important to

remember that filing an amendment does not automatically update all IRS

records, and truckers owners and operators are still responsible for paying

any additional taxes owed. Failure to pay these 2290 taxes by the due date can result in penalties.

We know the Form 2290

amendment process might seem a bit confusing at first—but don’t worry,

you’re not alone! Staying proactive and fixing any mistakes on your original

Form 2290 helps keep your business compliant with IRS rules and avoids any

unexpected HVUT penalties.

The best part? Filing a 2290 amendment

online is fast, easy, and totally stress-free. And with eForm2290, we make the process even smoother by guiding you every step of the way.

Whether you need to update your vehicle’s weight, mileage, or any other

info, we’ll help you submit your IRS Form 2290 amendment accurately and

securely.

Taking care of it now means peace of mind later—and

we’re here to help!

Frequently asked question on form 2290 amendment

1. Can Form 2290 be amended?

Yes, you can amend a Form 2290 return, but only under specific circumstances. You must file a Form 2290 amendment if:

- The taxable gross weight of a previously reported vehicle increases, resulting in additional tax owed.

- A vehicle previously reported as suspended exceeds the mileage use limit (5,000 miles for most vehicles or 7,500 miles for agricultural vehicles).

- A Vehicle Identification Number (VIN) was entered incorrectly on the original filing.

2. How long does it take the IRS to approve a 2290 amendment?

With eForm2290, your 2290 amendment filing can be processed directly with the IRS in just 15 minutes! Once it's filed and approved, you'll receive an email notification along with a new watermarked Schedule 1 reflecting the amended vehicle details.

3. Can you claim credit while filing a VIN amendment?

No, you cannot claim a credit while filing a VIN amendment.

A VIN amendment is specifically for correcting an incorrectly reported Vehicle Identification Number (VIN) on a previously filed Form 2290. It's not meant for claiming credits or refunds.

If you need to claim a credit for situations like a sold, stolen, destroyed, or low mileage vehicle, you’ll need to file a separate form — Form 8849, Schedule 6 — not as part of the VIN correction process.

4. What payment methods can I use to pay the HVUT?

When filing a Form 2290 amendment, you can pay the Heavy Vehicle Use Tax (HVUT) using any of the following IRS-approved payment options:

- Electronic Funds Withdrawal (EFW)

- Electronic Federal Tax Payment System (EFTPS)

- Credit or Debit Card

Choose the method that works best for you during the amendment filing process.

5. What is a VIN number?

A Vehicle Identification Number (VIN) is a unique 17-character alphanumeric code assigned to every motor vehicle at the time of manufacture. Much like a fingerprint, no two vehicles share the same VIN. It is used by the IRS to identify and track taxable vehicles for registration and tax filing purposes.

6. What vehicle categories can be amended on Form 2290?

When filing a Form 2290 amendment, you can make changes to the following vehicle categories:

- Taxable vehicles: If there was an error in the originally reported taxable gross weight or vehicle category (e.g., Category W to Category V).

- Suspended vehicles (Category W): If a suspended vehicle exceeds the mileage limit (5,000 miles or 7,500 for agricultural vehicles), it must be amended to a taxable category.

- Agricultural vehicles: Amendments can be made if the vehicle was incorrectly reported or if its usage changes.

- Logging vehicles: If the vehicle qualifies as a logging vehicle and was not reported correctly, you can amend it accordingly.

Amendments generally cover VIN corrections, gross weight increases, and suspended-to-taxable status changes.