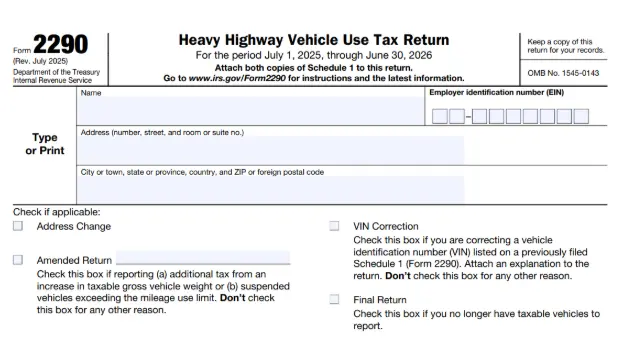

IRS Form 2290 Heavy Vehicle Use Tax Guide

Are you a trucker operating a heavy vehicle on public highways? If yes, you’re required to file IRS Form 2290, and you might be wondering exactly what it is and how to complete it. The process can feel overwhelming as a beginner, but don’t worry—we’ve got you covered on every aspect of 2290 filing.

Whether you're updating your tax status, reporting a new vehicle, or adjusting for weight changes, Form 2290 plays a crucial role in maintaining IRS compliance. The good news? Filing 2290 isn’t as complicated as it looks like. All you need to understand are the key deadlines and requirements before you start for a smooth filing experience.

In this simple guide, we’ll walk you through what Form 2290 is, what details you need to know or provide, and when exactly you need to file it.

What is a Form 2290?

Form 2290, officially known as the Heavy Highway Vehicle Use Tax Return, is a federal tax form used to report and pay the excise tax owed on highway motor vehicles. This tax applies to heavy vehicles with a taxable gross weight of 55,000 pounds or more that operate on public roads. The revenue collected helps fund highway maintenance and infrastructure.

All truck owners or operators must file Form 2290 annually, including those who purchase new or use a previously owned heavy vehicle during the current tax year. Additionally, vehicles expected to travel fewer than 5,000 miles per year (7,500 miles for agricultural vehicles) are considered suspended vehicles. Although no HVUT tax payment is owed on suspended vehicles, filing Form 2290 to report their status is still required for IRS compliance.

What is Form 2290 used for?

Form 2290 is used to file and pay the Heavy Vehicle Use Tax (HVUT) with the IRS. If you operate a heavy vehicle, are claiming a suspension, or are reporting changes in vehicle status, Form 2290 is required by the IRS to stay compliant with federal highway use tax laws. Broadly, Form 2290 is used to:

- Calculate and pay Heavy Vehicle Use Tax (HVUT) for highway vehicles with a taxable gross weight of 55,000 pounds or more that are operated during the tax year.

- Report and pay tax on previously suspended vehicles that exceeded the mileage limit (over 5,000 miles or 7,500 miles for agricultural vehicles) during the tax period.

- Update and pay tax for vehicles with increased weight if the vehicle’s taxable gross weight rises into a higher category during the filing period.

- Claim suspension from HVUT when a vehicle is expected to operate 5,000 miles or fewer (7,500 miles or fewer for agricultural vehicles) throughout the tax year.

- Request a credit or refund for vehicles that were sold, stolen, destroyed, or driven beyond the mileage limit after tax was already paid.

- Notify the IRS about the acquisition of a used vehicle that was previously suspended from tax liability by another owner.

- Report and pay HVUT on used vehicles that were acquired and placed into service during the tax year.

What is the purpose of IRS Form 2290?

The primary purpose of IRS Form 2290 is to calculate and collect the federal excise tax imposed on heavy highway vehicles. The revenue generated from this tax goes directly into the Highway Trust Fund, which supports the construction, repair, and maintenance of highways, bridges, and public transit systems across the United States.

Beyond funding infrastructure, Form 2290 also enables the IRS to track heavy vehicle usage and enforce compliance with federal tax laws. Truck owners and operators are required to file this form annually to report and pay the Heavy Vehicle Use Tax (HVUT), helping the IRS regulate the operation of large vehicles on public highways. While most commercial vehicles are subject to this tax, certain exceptions—such as low-mileage or exempt vehicles—may apply

Who needs to file IRS Form 2290?

You’re required to file Form 2290 and pay the Heavy Vehicle Use Tax (HVUT) annually if you own or register a highway motor vehicle that:

- Has a taxable gross weight of 55,000 pounds or more, and

- It is operated on public highways during the tax period

This requirement applies to individuals, corporations, partnerships, limited liability companies (LLCs), and other organizations registered under the laws of U.S. states, the District of Columbia, or those of Canada or Mexico. If the vehicle is registered in your name, you're responsible for filing the return, regardless of whether you're the driver or the fleet owner.

Entities like qualified subchapter S subsidiaries (QSubs) and single-owner disregarded entities are also required to file separately using an Employer Identification Number (EIN). An owner cannot file Form 2290 using a Social Security Number (SSN) or an individual Taxpayer Identification Number (TIN).

In cases where a vehicle is jointly registered with two parties, such as a business and an individual, the business (or primary registrant) is responsible for filing the taxes on time. The same goes for leased or dual-registered vehicles. Also, vehicles with a dealer tag, license, or permit are treated as being registered to the dealer.

The vehicle’s weight determines the federal excise tax for heavy vehicles. If your vehicle weighs less than 55,000 pounds, you’re not required to pay this HVUT tax. However, once a vehicle meets or exceeds that threshold, the tax applies—whether it’s used for farming, construction, transportation, or other commercial purposes.

When is Form 2290 due?

The due date for filing IRS Form 2290 depends on when your heavy vehicle is first used on public highways during the tax year, which is also known as the First Use Month (FUM). For the 2025–2026 tax period, the cycle begins on July 1, 2025, and ends on June 30, 2026.

Generally, Form 2290 must be filed immediately before your vehicle hits the road, and pay HUVT by the last day of the month following the vehicle’s first use month (FUM). For example, if your vehicle is first used in July, you’ll need to file the form immediately and pay the Heavy Vehicle Use Tax (HVUT) by August 31. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

If you begin using a vehicle later in the year, the deadline shifts accordingly. For instance, if you purchase and operate a taxable truck in March—you’ll need to file Form 2290 before the vehicle hits the road, and the payment is due by April 30. In such cases, you're only required to pay the tax for the period the vehicle was in use.

If you have multiple vehicles with different first used months, each one requires a separate Form 2290 filing based on its specific first use month (FUM). The IRS filing deadline is not tied to the vehicle’s registration renewal date, so be sure to file based on the actual month the vehicle was first used on a public highway, not when it was registered.

What happens if you don’t file Form 2290?

Missing the Form 2290 filing deadline can lead to costly penalties and accumulating interest for IRS non-compliance. If you fail to file and pay the Heavy Vehicle Use Tax (HVUT) on time, the IRS may impose the below penalties:

- Failure-to-file penalty: If you don’t file Form 2290 by the due date, the IRS charges a penalty of 4.5% of the total tax due, assessed for each month (or part of a month) the return is late, up to five months.

- Failure-to-pay penalty: In addition, if you file but fail to pay the HVUT on time, the IRS may charge a 0.5% penalty on the unpaid tax every month, up to a maximum of five months.

- Interest charges: On top of penalties, interest accrues at a rate of 0.54% per month on any unpaid balance until the full amount is paid.

The annual deadline to file Form 2290 is typically August 31, especially for vehicles first used in July, the beginning of the tax year. Filing late can result in delayed Schedule 1 processing, which may impact your ability to register your vehicle with the DMV or renew tags. To avoid penalties and registration issues, it’s important to file and pay Form 2290 on or before the deadline. Use a reliable e-file system such as eForm2290, which automatically calculates your HVUT based on the vehicle’s gross taxable weight and first use month and allows you to complete your filing in a few clicks.

How to file Form 2290?

If you operate a heavy vehicle on public highways, you’ll need to file IRS Form 2290 to report and pay the Heavy Vehicle Use Tax (HVUT). There are two ways to file: electronically (e-file) or by paper through the mail. While both options are available, e-filing is faster, easier, and more reliable, which the IRS also recommends.

Option 1: e-File Form 2290 (Recommended)

E-filing is the quickest and most efficient way to submit your return. Once filed, you’ll typically receive your stamped Schedule 1, the proof of payment, within minutes. This method also reduces the risk of errors and helps ensure your return is processed promptly.

You cannot e-file forms directly with the IRS. You must file Form 2290 through an IRS-authorized e-file service provider such as eForm2290. E-file is mandatory if you report 25 or more vehicles on a Form 2290. You just have to enter your vehicle details, calculate your 2290 tax, pay any balance due, and submit your return electronically. You’ll get your IRS-stamped Schedule 1 instantly, making it ideal if you're short on time, need quick proof of filing, or are simply looking for a convenient way.

Option 2: Paper filing

If you prefer to file by mail, you can complete Form 2290 manually and send it to the IRS via postal mail. Just keep in mind that paper returns take longer to process, and it may take several weeks to receive your Schedule 1. If you’re paper filing, make sure to mail your form well before the deadline to account for delivery and processing delays.

What documents and information are required to file IRS Form 2290?

To successfully file Form 2290 and calculate your Heavy Vehicle Use Tax (HVUT), you’ll need certain key details about your business and vehicles. Below is a checklist of what’s required:

1. Employer Identification Number (EIN): A valid EIN issued by the IRS is mandatory. Social Security Numbers (SSNs) are not accepted for filing Form 2290.

2. Business Name and Address: Ensure the business name and address you enter match the IRS records exactly to avoid processing delays or rejections.

3. Vehicle Identification Number (VIN): Provide the accurate VIN for each vehicle you're reporting. Mistakes in the VIN can delay your Schedule 1 or cause rejections.

4. Gross Taxable Weight of the vehicle: You must know the combined weight of the vehicle, trailers, and maximum load it typically carries. This determines the tax amount you owe.

5. Tax year: The HVUT tax period always runs from July 1 through June 30 of the following year.

6. First Use Month: Indicate the month the vehicle was first used on public highways during the tax year. This is essential for calculating the correct tax or prorated amount.

7. Vehicle category: Confirm if your vehicle is taxable (weighs 55,000 pounds or more), or qualifies as a suspended vehicle (expected to travel under 5,000 miles annually, or under 7,500 miles if used for agricultural purposes).

8. Preferred payment method: Choose how you plan to pay the HVUT - Electronic Funds Withdrawal (EFW),

Electronic Federal Tax Payment System (EFTPS), Credit or Debit Card, and Check or Money Order.

How much is the heavy vehicle use tax?

The Heavy Vehicle Use Tax (HVUT) is determined based on a vehicle’s taxable gross weight and the duration it is operated on public highways during the tax year. The tax applies to vehicles with a gross weight of 55,000 pounds or more that operate on public highways.

Here’s how the HVUT is determined:

- Vehicles weighing exactly 55,000 pounds pay a base tax of $100.

- For every additional 1,000 pounds over 55,000, an extra $22 is added to the tax.

- The maximum tax is $550, which applies to vehicles weighing 75,000 pounds or more (weight category “V”).

- Logging vehicles are taxed at a reduced rate, as they are used primarily for transporting harvested forest products.

- If your vehicle is first used in a month other than July, your tax will be prorated based on the number of months it was in use during the tax year (which runs from July 1 to June 30).

- If you sell or transfer a taxable vehicle during the tax year, you may be eligible to claim a credit or refund for any unused months. Be sure to maintain mileage logs and records to support any exemption or credit claims, especially for suspended vehicles.

Are there any exemptions from filing Form 2290?

Yes, certain vehicles and organizations are exempt from filing IRS Form 2290 for the Heavy Vehicle Use Tax (HVUT).

If a highway vehicle is owned and operated by any of the following, it does not need to be reported on Form 2290:

- The federal government

- State or local governments, including the District of Columbia

- The American Red Cross

- A nonprofit volunteer fire department, ambulance service, or rescue squad

- A recognized Indian tribal government

- A mass transportation authority

In addition, you’re not required to file Form 2290 for the following vehicle types:

- Qualified blood collection vehicles used by registered blood collector organizations

- Non-highway motor vehicles—these are specialized vehicles not designed for regular highway use, such as: mobile machinery used for non-transport purposes, road rollers, ditch-digging equipment, and well-drilling rigs

If your vehicle falls into one of these categories, you’re exempt from both filing and paying the HVUT.

However, for other types of exemptions, such as suspended vehicles that travel fewer than 5,000 miles annually (or 7,500 miles for agricultural use), a Form 2290 must still be filed even if no tax is due.

What are the payment options for the heavy vehicle use tax when filing the Form 2290?

When filing Form 2290, the IRS offers multiple payment methods to pay your Heavy Vehicle Use Tax. Here are the available options:

1. Electronic Funds Withdrawal (EFW)

If you're filing Form 2290 online through an IRS-authorized provider, you can do an Electronic Funds Withdrawal (EFW) by authorizing a direct debit from your checking or savings account. This is the simplest and fastest method—no extra steps are needed. Just enter your bank details during the filing process, and the IRS will automatically withdraw the tax amount.

2. Check or money order

You can mail a check or money order after submitting your Form 2290 electronically. Once your return is accepted, you’ll receive a Form 2290-V payment voucher.

- Make the payment out to “United States Treasury.”

- Include your name, Employer Identification Number (EIN), and “Form 2290” on the front of the check

- Always mail it along with the payment voucher to the IRS address

3. Electronic Federal Tax Payment System (EFTPS)

The Electronic Federal Tax Payment System (EFTPS) is a free and secure tax payment service offered by the U.S. Department of the Treasury. To use EFTPS:

- You must first enroll at www.eftps.gov

- Once enrolled, log in and schedule your HVUT payment

Make sure to submit the payment no later than 8:00 p.m. ET the day before the due date to ensure timely processing.

4. Credit or Debit Card

You can also pay your HVUT using a credit or debit card through IRS-approved third-party payment processors. A convenience fee is charged by these service providers. This method is secure and ideal if you prefer card payments.

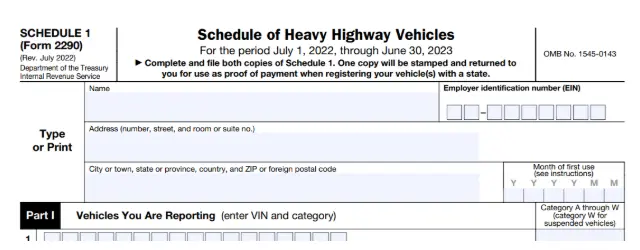

What is a Schedule 1 document for Form 2290?

Schedule 1 under Form 2290 is an official IRS-stamped document that serves as proof of filing and payment for the Heavy Vehicle Use Tax (HVUT). Once your Form 2290 is filed and the tax is paid, the IRS issues Schedule 1 as confirmation. Schedule 1 includes key information such as - Vehicle Identification Number (VIN), Tax amount paid,

Tax period covered (start and end dates) and IRS approval date.

This Schedule 1 document is essential for:

- Registering your vehicle or renewing tags with the Department of Motor Vehicles (DMV)

- Proof of HVUT compliance for audit or operational purposes

- Ensuring that federal tax regulations are complied with

When you file Form 2290 online through an authorized provider, your Schedule 1 is typically generated within minutes of IRS approval and is available to download, print, or submit for registration purposes.

Can Form 2290 be amended?

Yes, IRS Form 2290 can be amended if there are changes or corrections needed after you've submitted your original return. There are three common situations where filing an amendment is required:

1. Increase in Taxable Gross Weight

If your vehicle's gross weight increases, placing it in a higher weight category, you must file an amendment to report the change and pay the additional tax owed. This ensures your tax liability matches the new vehicle classification.

2. Exceeding the Mileage Use Limit

Vehicles initially reported as suspended (i.e., expected to travel 5,000 miles or less, or 7,500 miles for agricultural vehicles) must be amended if they exceed that limit during the tax year. Once the mileage threshold is crossed, the vehicle becomes taxable, and HVUT payment is required.

3. Correction of a Vehicle Identification Number (VIN)

If there was a mistake in the VIN on your original Form 2290, you need to file a VIN correction amendment. This ensures your tax records align with your vehicle registration and avoids issues during DMV processing.

Can Form 2290 get rejected?

Yes, IRS Form 2290 can be rejected if there are errors or missing information in your submission. Rejections typically occur during the IRS validation process when something doesn’t match their records or required criteria.

Form 2290 can be rejected by the IRS for several reasons. The most common issues include:

- Incorrect or missing Employer Identification Number (EIN)

- Mismatched or invalid Vehicle Identification Number (VIN)

- Errors in tax calculation

- Failure to meet IRS filing deadlines

These types of errors can lead to processing delays, potential penalties, and difficulty registering your vehicle, all of which can result in operational disruptions.

To stay compliant and avoid unnecessary setbacks, it’s essential to respond quickly to rejection notices, correct the issue, and resubmit the form. Using an IRS-authorized e-file provider like eForm2290 helps reduce the risk of rejection by checking for common errors before submission.

Can the deadline for Form 2290 be extended?

Yes, in limited situations, the IRS may grant an extension to file Form 2290, particularly in the case of natural disasters, federal system outages, or other special circumstances that prevent timely filing.

However, it’s important to note:

- The extension only applies to filing, not to the payment of the Heavy Vehicle Use Tax (HVUT).

- Any taxes owed must still be paid by the original due date to avoid penalties and interest.

- Late payments, even with a filing extension, may result in additional charges.

Why choose an IRS-Authorized e-file provider for Form 2290?

Filing through an IRS-authorized e-file provider such as eForm2290 ensures your Form 2290 submission is secure, accurate, and fully compliant with IRS regulations. We are approved by the IRS to meet strict data security and processing standards, ensuring your information is handled safely.

By using an authorized service, you benefit from:

- Fewer errors because of automated checks and built-in validations

- Timely submission, reducing the risk of penalties or delays

- Instant VIN correction tools to fix typos without refiling

- Accurate tax calculations based on your vehicle’s weight and the first use month

- Direct transmission to the IRS, ensuring fast Schedule 1 processing

- Dedicated customer support, making the process easier for both owner-operators and fleet managers

With eForm2290, you’re not just filing your return—you’re filing it right. Our platform streamlines the entire process, ensuring your submission is secure, compliant, and approved without unnecessary delays.

Frequently Asked Questions

Do I have to file Form 2290 every year?

Yes, you must file Form 2290 every year if you operate one or more heavy vehicles with a taxable gross weight of 55,000 pounds or more on public highways. The IRS requires you to file annually for each taxable vehicle.

What should I do if my e-filed Form 2290 is rejected due to a duplicate filing error?

If your Form 2290 is rejected for duplication, it means the IRS system has identified that a return with the same EIN, tax period, and VIN (Vehicle Identification Number) has already been submitted. This can happen if:

- You’ve accidentally resubmitted a previously filed return.

- You’ve listed VINs already reported in another return for the same period.

In such cases, here’s what you have to do:

- Double-check all VINs to ensure they are accurate and not repeated from a prior submission.

- Correct any duplicate information and resubmit the return electronically.

If you're correcting a VIN from a return that was already accepted, you must:

- File a paper Form 2290.

- Select the “VIN Correction” box on page 1.

- If the new VIN is significantly different from what was originally reported, include a brief explanation for the change.

Can I claim a refund for a vehicle that was sold, destroyed, or stolen during the tax period?

Yes. If you paid HVUT for a vehicle that was sold, destroyed, or stolen, you may be eligible for a refund or credit.

You have two options:

- Claim a credit on your next Form 2290 filing within the same or a future tax period.

- Request a refund using Form 8849, Schedule 6 – Other Claims.

The refund amount is based on when the vehicle was taken out of service. Make sure to provide accurate records showing the date of sale, destruction, or theft.

Can I get a refund if my vehicle was driven less than 5,000 miles during the tax year?

Yes. If you already paid the HVUT for a vehicle that was operated less than 5,000 miles (or 7,500 miles for agricultural vehicles) during the tax year, you’re eligible to claim a credit or refund.

You can:

- Claim a credit on the next Form 2290 you file.

- Or submit Form 8849, Schedule 6 , to request a refund.

You must wait until the next tax period begins before you can file for a refund or credit. Also, refunds or credits are not available for occasional light loads, reduced usage, or temporary discontinuation of vehicle operation.

How do I increase the weight category of a vehicle after filing Form 2290?

If you've already submitted your Form 2290 and paid the Heavy Vehicle Use Tax, but later realize that the vehicle's taxable gross weight has increased, you can easily correct it by filing an amended return. This process is officially called a Taxable Gross Weight Increase.

You’ll only need to update the specific VIN for the vehicle whose weight category has changed. There’s no need to amend the entire return. Just select the amended return option, make the necessary changes, and submit.

How long do I need to keep records related to Form 2290?

It’s important to keep records of all taxable highway vehicles registered under your name or business for a minimum of three years after the tax is paid or becomes due, whichever is later. These records serve as proof of compliance and may be needed for audits or registration renewals.

When you e-file Form 2290 through our platform, your IRS-stamped Schedule 1 is securely stored in your account and can be downloaded anytime. You’ll also have access to your previously filed 2290 returns, keeping all your HVUT documents organized and easily accessible in one place.